What Does Paul B Insurance Do?

Table of ContentsGetting My Paul B Insurance To WorkAn Unbiased View of Paul B InsurancePaul B Insurance for DummiesPaul B Insurance Can Be Fun For EveryoneA Biased View of Paul B Insurance

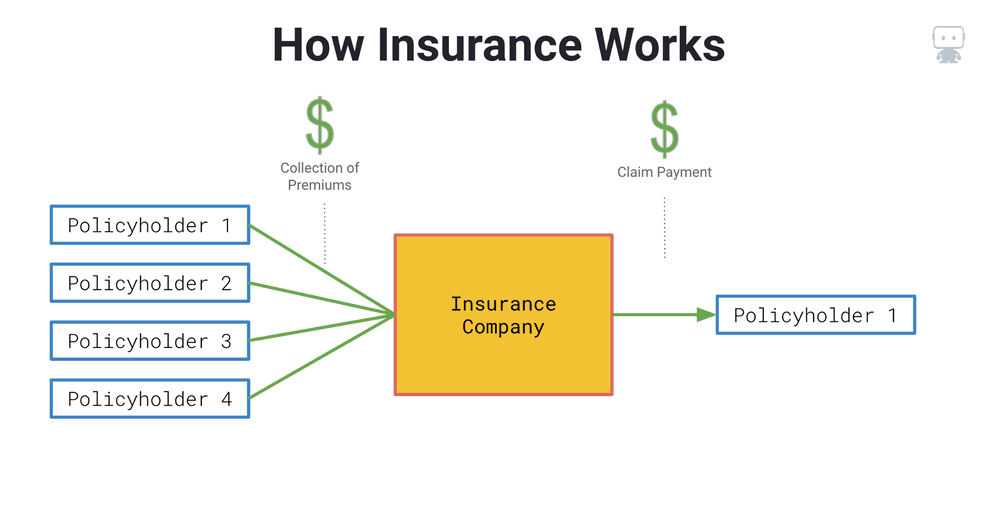

The idea is that the cash paid in cases gradually will be much less than the complete premiums accumulated. You might seem like you're throwing cash gone if you never sue, yet having item of mind that you're covered in case you do suffer a considerable loss, can be worth its weight in gold.Visualize you pay $500 a year to guarantee your $200,000 house. This implies you've paid $5,000 for house insurance.

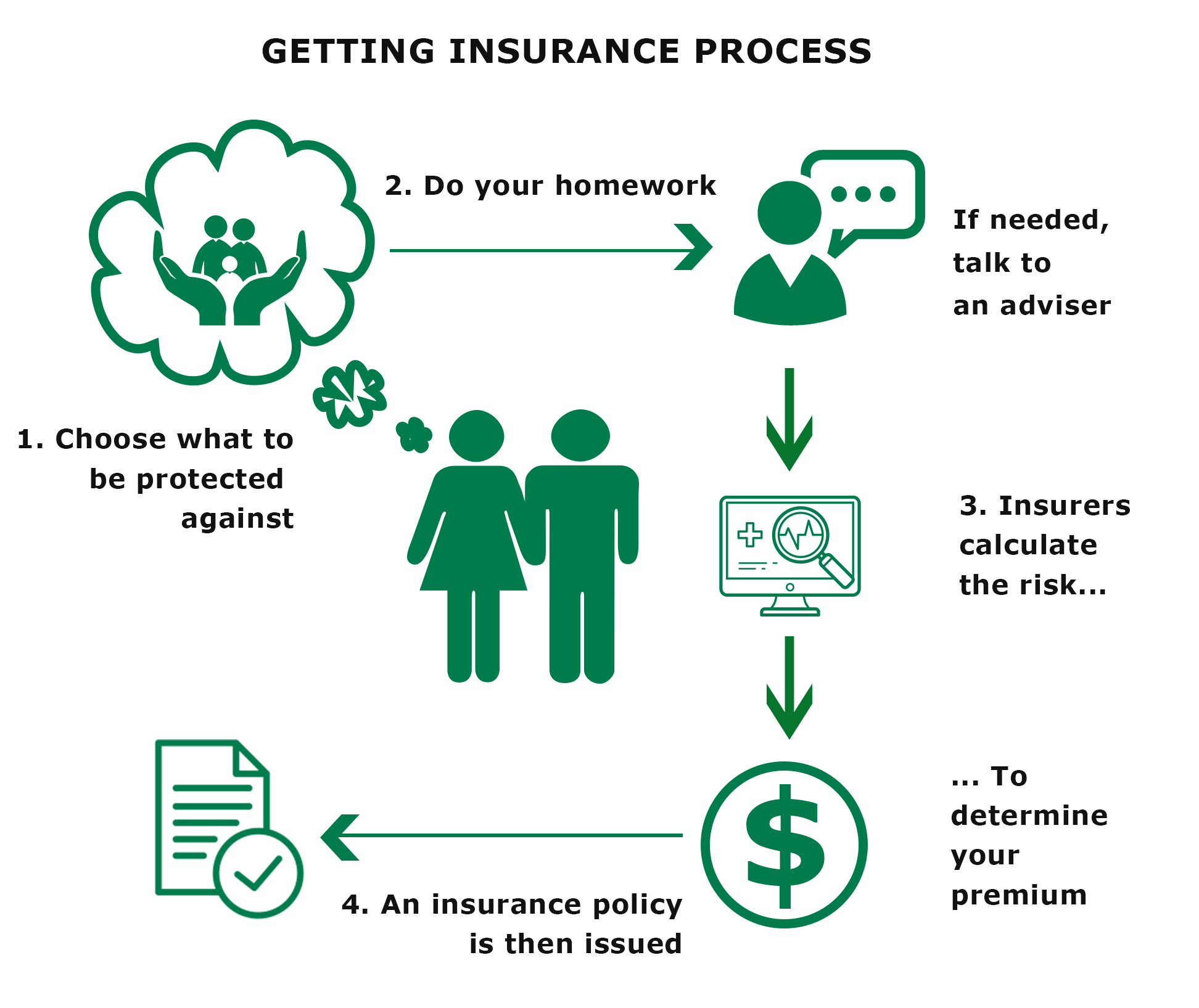

Due to the fact that insurance coverage is based upon spreading the danger among many individuals, it is the pooled cash of all people paying for it that permits the firm to construct assets and cover insurance claims when they happen. Insurance coverage is an organization. Although it would behave for the companies to just leave rates at the very same level all the time, the fact is that they have to make sufficient money to cover all the possible claims their insurance holders may make.

More About Paul B Insurance

Underwriting modifications and price boosts or reductions are based on outcomes the insurance policy business had in past years. They market insurance policy from only one company.

The frontline individuals you deal with when you buy your insurance are the representatives as well as brokers who stand for the insurance business. They a familiar with that business's products or offerings, however can not talk in the direction of various other companies' policies, prices, or product offerings.

Everything about Paul B Insurance

The insurance you need differs based on where you go to in your life, what kind of properties you have, and what your lengthy term goals as well as duties are. That's why it is vital to take the time to review what you desire out of your policy with your representative.

If you get a funding to get a vehicle, as well as after that something happens to the car, void insurance policy will repay any section of your financing that typical automobile insurance does not cover. Some loan providers need their customers to lug gap insurance policy.

3 Simple Techniques For Paul B Insurance

Life insurance policy covers the life of the guaranteed individual. The insurance policy holder, that can be a various person or entity from the guaranteed, pays costs to an insurance provider. In return, the insurance company pays a sum of money to the beneficiaries listed on the policy. Term life insurance policy covers you for a period of time selected at acquisition, such as 10, 20 or 30 years.

If you don't pass away during that time, no person earns money. Term life is popular due to the fact that it provides big payouts at a reduced price than irreversible life. It additionally go to website gives coverage for a set number of years. There are some view publisher site variations of normal term life insurance coverage plans. Exchangeable plans enable you to transform them to irreversible life plans at a higher premium, enabling longer as well as possibly extra flexible coverage.

Irreversible life insurance coverage plans construct cash value as they age. The money value of entire life insurance plans grows at a fixed price, while the cash worth within global plans can vary.

The Facts About Paul B Insurance Revealed

If you compare ordinary life insurance coverage prices, you can see the difference. $500,000 of entire life insurance coverage for a healthy and balanced 30-year-old lady prices around $4,015 annually, on average. That very same degree of coverage with a 20-year term life plan would certainly cost an average of concerning $188 each year, according to Quotacy, a brokerage firm.

Variable life is one more irreversible life insurance option. It's an alternate to whole life with a fixed payout.

Here are some life insurance policy fundamentals to aid you better comprehend how protection functions. For term life plans, these cover the expense of your insurance policy as well as management expenses.